Investing.com – Il contratto con scadenza a giugno 2017 chiude oggi a 20.285 punti, in contrazione del -0.01 %.

Al momento si collocano in terreno positivo 17 titoli su 40, con un range di variazione che va dal migliore (Mediobanca (MI:)) con un guadagno del +3.88%, al peggiore (Yoox Net-A-Porter Group SpA (MI:)), che cede del -1.81%.

Analisi:

sembra che siamo già in vacanza…la Festa dei Lavoratori del primo di maggio fa sentire la sua presenza e i mercati sono svogliati: basta osservare le variazioni percentuali di chiusura dei listini europei per rendersene conto, si tratta di pochi decimali. La situazione risulta pertanto quasi invariata rispetto a ieri e tutto viene rimandato alla prossima settimana. Il contratto Future sul paniere milanese è rimasto in un ristretto range con continui up & down, che hanno in chiusura espresso una impercettibile tendenza ribassista. Pur in presenza di buoni volumi di scambio, la quotazione è riisultata poco variata in chiusura. Anche l’analisi della situazione generale rimane pertanto invariata, con il livello di 20650 a far da supporto e soglia d’accesso per un ulteriore ribasso verso area 20150 o meno. Anche Il primo target rialzista di medio periodo rimane invariato e compreso fra i valori di 20660 e 20750, per poterlo vedere raggiunto è ora necessaria una reale violazione del precedente massimo, postato in data 25 aprile a 20560 punti. Nessuna operazione basata sui segnali rilasciati tramite il canale Telegram è stata oggi eseguita. collegatevi per la prossima settimana, trovate l"indirizzo nel mio profilo personale. Chi desidera ricevere i segnali settimanali di lungo periodo gratuiti, può chiederli mandando “richiedo” al mio indirizzo email personale, reperibile sul mio profilo qui sul sito Investing.com al seguente indirizzo: http://it.investing.com/members/2919 (copiare e incollare nella barra degli indirizzi del browser). Questi utili e gratuiti servizi sono offerti esclusivamente ai lettori del sito italiano di Investing.com, fatelo conoscere ai vostri amici, invitandoli a visitare e registrarsi sul sito it.investing.com, i lettori del sito Investing.com, beneficiano sempre di servizi utili e totalmente gratuiti. Buonasera. E Buona festa del 1° maggio. Francesco Lamanna

Future FTSE MIB, grafico su tf a 15 minuti

Chi gradisce questa analisi di fine giornata che viene qui regolarmente pubblicata, è gentilmente invitato a cliccare sul tasto "segui", manifestando, in tal modo, il suo gradimento.

Posizioni & operazioni del 2017:

Operazioni di trading in corso: short da 18.135 punti del 7 dicembre 2016 (CFDs)

Operazioni di trading aperte oggi: nessuna

Operazioni di trading chiuse oggi: nessuna

Ordini pendenti in attesa d’esecuzione: Ordine di vendita a livello molto superiore all’attuale (medio medio-lungo periodo); vedi segnali gratuiti Vedaforex®.

Gli indici migliori del , alle 17.50, oggi sono:

FTSE Italia Tecnologia (+3.09%)

FTSE Italia Beni e Servizi Industriali (+0.58%)

FTSE Italia Industria (+0.54%)

Gli indici peggiori invece sono:

FTSE Italia Beni Immobili (-0.87%)

FTSE Italia Alimentari (-0.76%)

FTSE Italia Telecomunicazioni (-0.74%)

La sessione odierna ha visto scambiare sino alle ore 17.40, n° 721.060.653 azioni per un controvalore pari a 2.555.220.905 Euro; i contratti conclusi sono stati 275.651 e le azioni in negoziazione sono state 360, delle quali 191 hanno chiuso in rialzo e 150 in ribasso; 19 sono quelle rimaste invariate.

I titoli oggi più scambiati in capitale sono stati:

Intesa (MI:) :

Volume di scambio di 134M di titoli, per un controvalore di 357M di euro

Unicredit (MI:) :

Volume di scambio di 23.1M di titoli, per un controvalore di 345M di euro

Eni (MI:) :

Volume di scambio di 12.4M di titoli, per un controvalore di 177M di euro

I titoli migliori sull"indice milanese sono in chiusura:

Mediobanca (MI:) quotato 8.825 (+3.88%)

STM (MI:) quotato 14.84 (+3.63%)

Banca Popolare dell Emilia Romagna (MI:) quotato 5.020 (+3.21%)

Fra i peggiori troviamo oggi:

Yoox Net-A-Porter Group SpA (MI:) quotato 24.40 (-1.81%)

Saipem (MI:) quotato 0.3956 (-1.54%)

Campari (MI:) quotato 10.86 (-1.27%)

I rendimenti dei BTP italiani sono stati oggi del +2.28% sulla scadenza a 10 anni, del +1.07% su quella a 5 anni e del +0,03% su quella a 2 anni.

Negative, con l’eccezione di Zurigo, le altre maggiori piazze europee con gli Indici di: Amsterdam che scende del -0.15%, Parigi che chiude in peggioramento del -0.08%, Francoforte , che diminuisce del -0.05%, Londra che è in discesa del -0.46%, Madrid positiva del +0.30% e Zurigo in perdita del -0.36%.

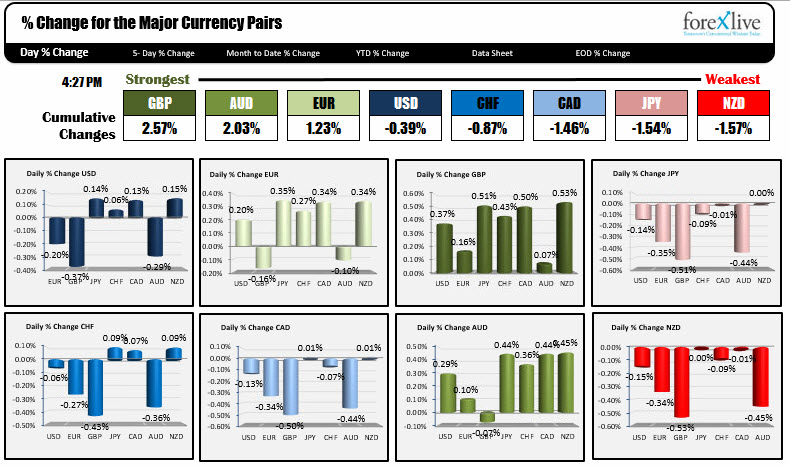

Su base giornaliera, oggi il cross , ha assunto un andamento rialzista (+0.37% al momento della scrittura), il cambio ha raggiunto un massimo a 1.0948 ed un minimo a 1.0857; la coppia scambia ora a 1.0905.

Future FTSE MIB, Orsi o Tori, nessuno si impegna...Future FTSE MIB, Orsi o Tori, nessuno si impegna...

http://it.investing.com/rss/market_overview.rss

$inline_image !!! CLICK HERE TO READ MORE !!! Future FTSE MIB, Orsi o Tori, nessuno si impegna... Forex Blog | Free Forex Tips | Forex News http://www.forextutor.net/future-ftse-mib-orsi-o-tori-nessuno-si-impegna/

May/Tusk discussions could be getting a little less cosy

May/Tusk discussions could be getting a little less cosy