Forex news for trading on April 28, 2017.

- US stocks end the session with small declines

- CFTC Commitments of Traders: Shorts increasing in the CAD. GBP shorts trimmed a bit.

- Key earnings releases next week: AMD, Merck, Apple, Facebook, Tesla...FOMC and US Employment too

- US Crude oil futures settle the week $49.33 /BBL

- Goldman raises chance for a June rate hike to 70%

- Baker Hughes total rig count comes in at 870 vs 857 last week

- S&P: Ratings On United Kingdom Affirmed At "AA/A-1+"

- Gold up a few bucks in trading today

- IFOP poll has Macron at 60% and LePen at 40%

- European stocks end the mixed. Gains for the week.

- NY Fed Nowcast sees 2Q GDP at 2.3% (from 2.1%)

- US House of Representatives votes to avert government shutdown for a week

- US Sec. of State Tillerson: Threats of nuclear attack on Japan and S.Korea real

- Blackrocks Larry Fink not speaking to positively about US

- US April University of Michigan sentiment index final 97.0 vs 98.0 exp

- Chicago April PMI 58.3 vs 56.2 exp

- Chances of 2 more rate hikes this year rise after US GDP data

- Canada Industrial Prod Prices 0.8 % vs. 0.3% est. Raw Material Prices -1.6% vs -0.5%

- US Q1 annualized GDP flash qq 0.7 % vs 1.0% exp

- February 2017 Canadian GDP 0.0% vs 0.1% exp m/m

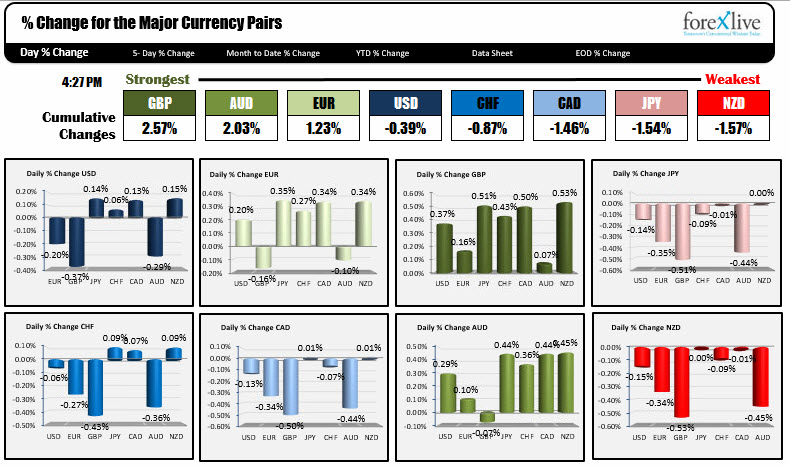

- The strongest and weakest currencies as NA traders enter for the day

In other markets today:

- Spot gold was up $4.10 or 0.32%

- WTI crude oil is up $0.21 to $49.18

- US stocks were lower. S&P fell by -0.19%, Nasdaq was down by -0.02% and the Dow was down by -0.19%

- In the US debt market: 2 year yield 1.265% up 0.8 bp. 5 year 1.8175%, down -0.4 bp. 10 year yield 2.287%, down -0.7 bp. 30 year yield 2.956%, down -0.7 bp.

The US GDP data for the 1Q came in at plus 0.7% "annualized" vs 1.0% estimate. Since the quarter is "annualized", it means the QoQ growth was less than 0.2%. That is not a lot and certainly not what you would have expected with all the hoopla from the soft data spikes on the back of the Trump presidency. But, for whatever reason, the seasonal for the 1Q are notoriously off (with a downward bias), so the market shrugged off the weakness and chose to keep the dollar mixed with gains against the JPY, CHF, CAD and NZD and losses against the EUR, GBP and AUD.

The regional Chicago PMI came in better than expected at 58.3 vs 56.2. On Monday and Wednesday, we will get the national Manufacturing and non-Manufacturing data. The University of Michigan final look for April was weaker at 97.0 vs 98.0. Still, that is near high levels that existed before the 2008 crash that saw the index move from 97.0 to around 55.0.

Other than that, there was talk from Sec. of State Tillerson, UK PM May, BOJ Abe and even China about N. Korea and the risk from that tiny nation. Gold ended the day up $4.00 but I would not say the fear factor led to the small bid today.

In the stocks today, the indices ended near low levels despite blow away earnings from AMZN, Alphabet after the bell on Thursday. No new record for the Nasdaq today but the week ended with gains led but the Nasdaq which a gain of 2.32%.

In ca

-------------------------------------

Below is a snapshot of the % changes of the major currencies vs each other. The GBP was the strongest. For the GBPUSD it marched higher away from the 1.2900-14 level today. The NZDUSD was the weakest.

Forexlive Americas forex news wrap: US GDP tiny, but who cares? It"s just the 1Q.

Forexlive Americas forex news wrap: US GDP tiny, but who cares? It"s just the 1Q.

http://www.forexlive.com/feed/news

$inline_image !!! CLICK HERE TO READ MORE !!! Forexlive Americas forex news wrap: US GDP tiny, but who cares? It"s just the 1Q. Forex Blog | Free Forex Tips | Forex News http://www.forextutor.net/forexlive-americas-forex-news-wrap-us-gdp-tiny-but-who-cares-its-just-the-1q/

Nessun commento:

Posta un commento